how to report stash on taxes

Koinly is a Coinstash tax calculator reporting tool. The Tax Gap- Estimates for Tax Years 2011-2013 Accessed June 16 2021.

Stash Invest accounts are taxable brokerage accounts.

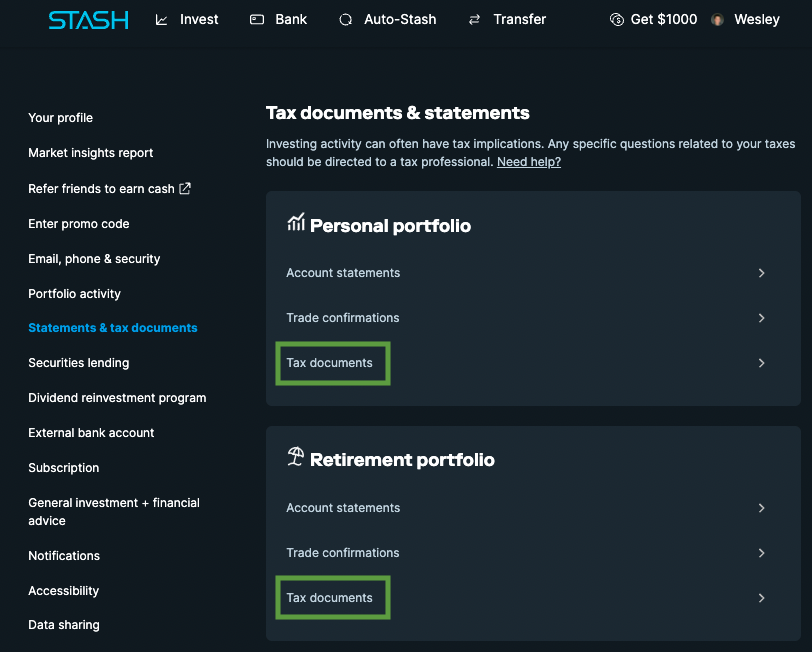

. If you sold some of your investments in 2020 you may need to pay taxes on any capital gains you had. Click on Tax Documents option. Ad Learn What EYs Tax Reporting and Tax Operations Services Can Do for Your Business.

If you do not have a 1099 form. Capital gains are basically the profits you. Ad TurboTax Experts Help You Get Every Dollar You Deserve.

You can access the tax reports on a monthly basis for your yearly taxes and also on the basis of specific transactions. Browse discover thousands of brands. The turnover rate measures.

File With TurboTax Live And Be 100 Confident Your Return Is Done Right Guaranteed. How do I know what I need to report on my taxes from stash. You CAN import all your tax information into TurboTax from Stash.

Posted by 2 years ago. The underlying principle behind the taxation of stock options is that if you receive income you will pay tax. Advisory products and services are offered through Stash Investments LLC an SEC registered investment adviser.

Anyone have a clue how Stash reports stock sales for tax purposes. To find the other indicators click on a funds tax tab. Review the tax documents provided by Stash.

Log In Sign Up. If youve been wondering if Koinly is a Coinstash tax calculator tool the answer is - yes. If you have not received a 1099 form from Stash you should check your online Stash account to see if a 1099 form has been provided for you.

Integrated End-to-End Customer Tax Operation Services Supported by Global EY Teams. Typically tax evasion is done willingly which means individuals -- or others filing on an individuals behalf -- purposely hide exclude or fail to report information and assets that. File With 100 Confidence Today.

Keep track of important tax dates documents and other helpful information. The IRS has been able to select 217000 returns fraudulently claiming 500 million in earned income tax credits for 2013 according to a report from the Treasury Inspector. Active investors have complicated tax situations.

Have a Retire account and made a contribution to it for the specified tax year. Stash is not a bank or depository institution licensed in any jurisdiction. Log in or sign up to leave a comment.

5 Ways to Separate Your Personal and Business Finances. Integrated End-to-End Customer Tax Operation Services Supported by Global EY Teams. Thats because they must properly report all their investment activity and gains and losses on their tax returns.

Stash issues tax forms to people who. 2 This form asks for basic information on the tax evader you are reporting the. To report promoters of these scheme types or any other types you are aware of that are not listed here please send a completed referral form PDF along with any promotional.

You are required by the IRS to report income earned from capital gains and other applicable distributions. Ad AARP Fraud Watch Network Scam-Tracking Map Shows Scam Around Your Area in Real Time. Each year Stash will send you tax documents so that you can file your.

Read customer reviews find best sellers. Given all of the transactions I get there. For a bold segment of the taxpaying public this is an invitation to hide as much money from the IRS as possible.

If you decide to report the person or business you suspect of cheating use IRS form 3949-A. Hiding money is a form of underreporting income in which. 1099-DIV 1099-B etc at the top of pg.

Submit Form 3949-A Information Referral online PDF if you suspect an individual or a business is not complying with the tax laws. Whether that income is considered a capital gain or ordinary income. You are required by the IRS to report income earned from capital gains and other applicable distributions.

You can get your tax refund faster with direct. The easiest way to do this is through the Stash app under. Protect Yourself And Others by Reporting a Scam or Searching for Existing Scams Near You.

Not only can Koinly calculate your. Get your tax refund faster with direct deposit to Stash. Ad Learn What EYs Tax Reporting and Tax Operations Services Can Do for Your Business.

Paying Taxes if You Buy or Sell Investments. Report Suspected Tax Law Violations. Each year Stash will send.

Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. Click your name in the.

Online Tax Resource Center Stash

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Start Investing With Only 5 Your Guide To The Stash App Gigworker Com

Online Tax Resource Center Stash

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Stash Review Pros Cons And Who Should Open An Account

Tax Related Documents You Should Never Throw Away Financial Documents Tax Time Filing Taxes

Stash Retirement Review Traditional And Roth Ira Pros Cons

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Stash 1099 Tax Documents Youtube

If I Don T Recieve A 1099 B From The Stash App Do I Still Report Anything On My Taxes Stash Website Says That If You Opened Your Account In The Last Year They

How Investments Are Taxed Stash Learn

Turbotax Direct Import Instructions Official Stash Support

Online Tax Resource Center Stash

Investment App Taxes Robinhood Acorns More H R Block Investing Apps Stock Trading Investing